Aforti Holding – a company that has been listed on NewConnect since August 2011 and offers lending, debt collection and factoring services to SMEs and manages an online currency exchange platform for companies – sold 1,334,872 shares of a subsidiary company of Aforti Finance for PLN 6.9 million on the basis of private placements.

The selling price of a single share was PLN 5.20, therefore Aforti Finance was priced at PLN 57.2 million. Prior to the transaction, Aforti Holding held 9,262,632 shares of its subsidiary Aforti Finance, which constituted 84.21 percent of its share capital, and now it controls 72.07 percent of the capital. Aforti Finance’s entry on New Connect is planned in the middle of 2018.

Aforti Finance’s activity on the capital market is an element of the Aforti Group’s strategy for years 2018-2020, which includes – besides the Aforti Holding’s entry onto the main trading floor of the Warsaw Stock Exchange at the turn of 2018 and 2019, and the debut of Aforti Finance on New Connect – also the fintech company Aforti Exchange going public in the international market.

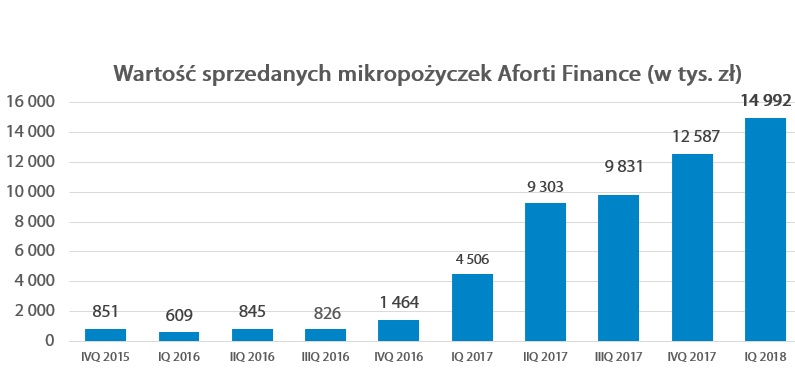

The online currency exchange platform for companies, managed by AFORTI Group, is currently available in the Polish and Romanian markets, and soon the company will start its operational activity in Bulgaria. Another step in its development will be the currency exchange bureau’s international expansion to at least 7 more countries, i.e. Czech Republic, Hungary, Croatia, Serbia, Bosnia and Herzegovina, Albania and Macedonia. Finally – within the next few years – at locations in which Aforti Exchange will start its business activity, the plans also include the international development of Aforti Finance, specializing in the non-bank financing of SMEs. From 2016 to the end of Q1 2018, the value of credits granted to entrepreneurs by Aforti Finance reached almost PLN 55 million.

“The excellent standing of Aforti Finance in the domestic lending market, and therefore its strong financial position, makes this moment perfect to go public. The valuation of shares – sold on the basis of private placements for PLN 5.2 per share – confirms that the decision to introduce them to trading in the Alternative Trading System on NewConnect already in 2018 will enable a diversification of sources of funding, and thus allocation of a part of assets obtained to further dynamic growth of Aforti Finance in Poland and abroad. Importantly – the Aforti Holding’s strategy clearly and prominently assumes that sale of shares of Aforti Finance and potentially of other subsidiaries, will be carried out only to such an extent that will not result in the loss of control and the dominant position of Aforti Holding among subsidiaries” – stresses Klaudiusz Sytek, the President of the Management Board of Aforti Holding.

In 2018/2019, the Aforti Group – in reference to Aforti Finance – plans, inter alia, the introduction of online submission of applications and establishment of its own call centre that will enable efficient and effective customer service.

In 2017, the amount of loans granted by Aforti Finance to micro, small and medium-sized enterprises was nearly PLN 36.23 million, with 465 positively reviewed applications (of 2,317 applications submitted in the period for the total amount of over PLN 191 million).

Thus, Aforti Finance recorded over 867 percent increase in the value of financial support provided to enterprises, with the quantitative increase by 347 percent in respect of the number of successful applications.